Other taxable income 2018 (HS325) GOV.UK If you have a tax shelter, enter the tax shelter identification number found on your T5013 slip on the proper line. If you are claiming a deduction or losses for 2019, attach to your income tax return any applicable slip T5003, Statement of Tax Shelter Information, and a completed form T5004, Claim for Tax Shelter Loss or Deduction.

How to File ITR 3 for AY 2018-19 Income Tax Return for

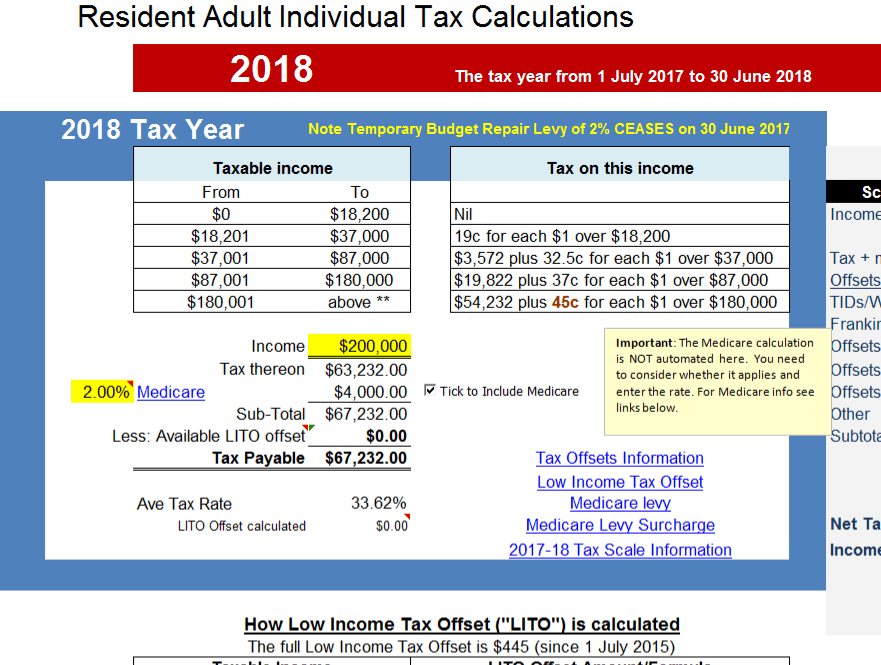

Individual tax return instructions 2018 Australian. Any compensation you receive as a poll worker is to be reported as taxable on your IRS Form 1040, U.S. Individual Income Tax Return, even if you do not receive an IRS Form W-2, Wage and Tax Statement, for this work.However, if you earned more than $600 in wages …, As a commission employee, there are a variety of expenses that you can claim on form T777, Statement of Employment Expenses, when you file your personal income tax return.These costs commonly include accounting fees, legal fees, and costs for business cards, promotional gifts, cellphones, and computers..

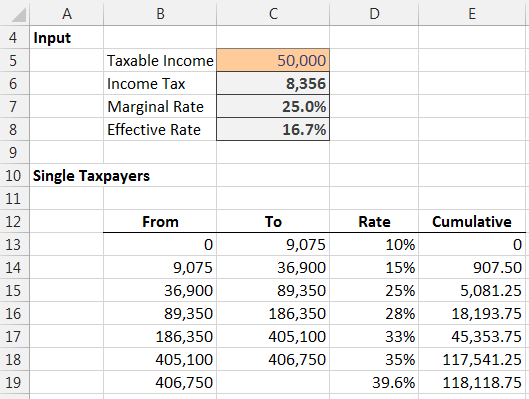

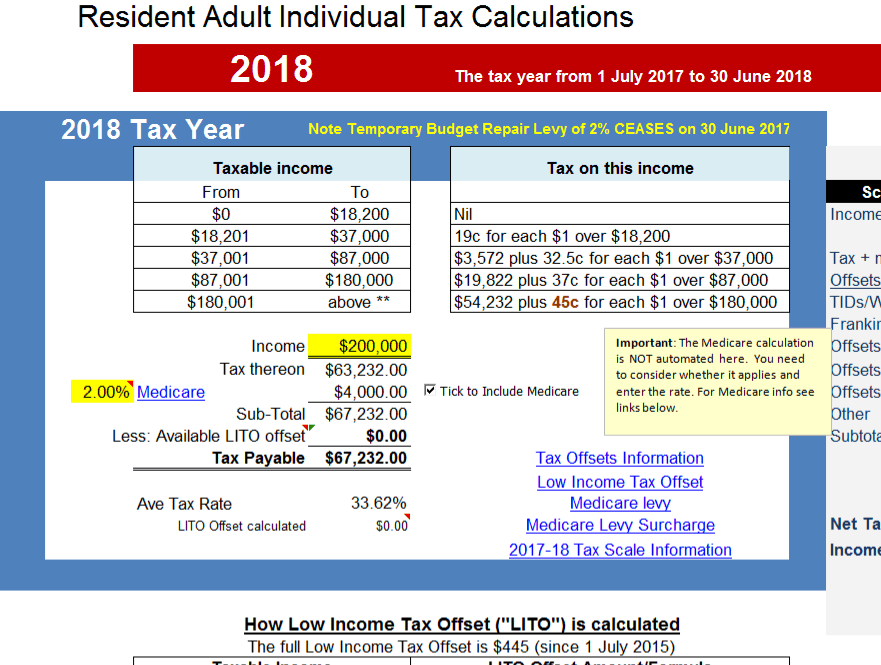

Oklahoma Tax Commission Website. Ledger Reports Tax Collections by NAICS Oklahoma Equal Opportunity Education Scholarship Credit Current tax rates in Ontario and federal tax rates are listed below and check. IMPORTANT: This tax calculator is used for income tax estimation. Please use Intuit TurboTax if you want to fill your tax return and get tax rebate for previous year. It is free for simple tax returns or gives you 10% discount for more complicated tax returns.

Most Lyft customers can import their information from Lyft. Use these instructions if you prefer to enter them yourself. Most of what you need is provided in your Lyft account on your Lyft Tax Information page. You can also sign in to your account, look under the Driver heading, and select Tax Infor... Individual tax return instructions 2018. The following information will help you with completing your tax return for 2018. These instructions are in the same order as the questions on the Tax return for individuals 2018.

Can I Deduct Realtors' Commissions on My Income Tax Return? By: or $500,000 on a joint return, Everything from the size of the commission to who pays it may be negotiable in a sale. Guide to Completing the PST Return. This guide explains how to complete the Provincial Sales Tax (PST) Return Completing the Provincial Sales Tax Return Worksheet. Enter all amounts in Canadian dollars. Step 1 Box A Commission. Enter the commission amount as detailed on the worksheet.

Individual tax return instructions 2018. The following information will help you with completing your tax return for 2018. These instructions are in the same order as the questions on the Tax return for individuals 2018. Adjustment for income replacement indemnities. If you were resident in Québec on December 31, 2019, and you received income replacement indemnities or compensation for the loss of financial support from the CNESST or the SAAQ, enter the amount from Box M of your RL-5 slip (maximum $13,742.10). This will reduce the basic personal amount for 2019, which was taken into account in calculating

Improvements to Ontario's tax services include updating the RST return to make it easier for you to read and use. This document provides instructions on how to complete your RST return. Other taxable income 2018 (HS325 commission and freelance income that’s not If you haven’t included that tax in box 2 of the Employment page of your tax return, enter it in

If you received a Form 1099, you'll find your commission earnings in box 7. Report this commission and other income on line 1 of your Schedule C or Schedule C-EZ. You will also use the Schedule C or C-EZ to report commission income if you receive a W-2 with the statutory employee box checked on line 13. If you live in Ontario, you may qualify for the Ontario Energy and Property Tax Credit (OEPTC), that is a part of the Ontario Trillium Benefit.. Though we technically are not claiming rent on our taxes, the amount of rent, property taxes, or long term housing costs paid by you throughout the year is used to help calculate your benefit.

28.01.2019 · Turbotax is the software I use to file my family's taxes. I've been using Turbotax going on nearly 25 years with a 3 yr break when we lived in NJ. Because I worked in Philly I had to file the Improvements to Ontario's tax services include updating the RST return to make it easier for you to read and use. This document provides instructions on how to complete your RST return.

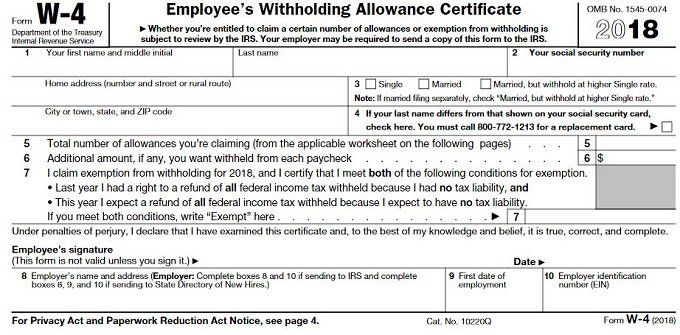

29.01.2020 · Employees who earn commissions with expenses. Employees who are paid in whole or in part by commission and who claim expenses may choose to fill out a Form TD1X, Statement of Commission Income and Expenses for Payroll Tax Deductions in addition to Form TD1. To calculate the amount of tax to deduct, you can use the Payroll Deductions Online Calculator, the Payroll Deductions … Individual tax return instructions 2018. The following information will help you with completing your tax return for 2018. These instructions are in the same order as the questions on the Tax return for individuals 2018.

Improvements to Ontario's tax services include updating the RST return to make it easier for you to read and use. This document provides instructions on how to complete your RST return. Current tax rates in Ontario and federal tax rates are listed below and check. IMPORTANT: This tax calculator is used for income tax estimation. Please use Intuit TurboTax if you want to fill your tax return and get tax rebate for previous year. It is free for simple tax returns or gives you 10% discount for more complicated tax returns.

I would create a service item called commission earned, select your commission income account on the item screen. use that item on a sales receipt when you get the commission and then deposit the funds (you can use a generic customer, or create that company as a customer <- if there is any chance other companies will be paying you in the future this is the better option. Do You Understand 'Employment Expenses' on Your Tax Return? There are a wild variety of employment expense claims that tax-filers make. Dry cleaning and teeth-whitening for on-air performers?

Finding the Right Industry Code for Your Business Tax

Solved How/Where do I claim rent paid in Ontario? Community. enter $5,055. If your net income for the year will be between $37,635 and $71,335 and you want to calculate a partial claim, get Form TD1ON-WS, Worksheet for the 2018 Ontario Personal Tax Credits Return, and fill in the appropriate section. 3., This program combines 1. Ontario Sales Tax, 2. Ontario Energy and Property Tax Credit (Rent, energy, property tax) and 3. Northern Energy Credit (for taxpayers living in Northern Ontario) This benefit does not affect the tax return, It is paid out separately just like the GST and CTB credit..

Preparing T1 Returns – Reporting income and inputting T

2018 TC-40 Utah Individual Income Tax Instructions. Employer Health Tax (EHT) is a payroll tax on remuneration paid to employees and former employees. Effective January 1, 2019, the EHT exemption is increased from $450,000 to $490,000. The EHT exemption is adjusted according to inflation every five years using the Ontario Consumer Price Index. https://en.wikipedia.org/wiki/Flint_water_crisis I would create a service item called commission earned, select your commission income account on the item screen. use that item on a sales receipt when you get the commission and then deposit the funds (you can use a generic customer, or create that company as a customer <- if there is any chance other companies will be paying you in the future this is the better option..

Individual tax return instructions 2018. The following information will help you with completing your tax return for 2018. These instructions are in the same order as the questions on the Tax return for individuals 2018. This program combines 1. Ontario Sales Tax, 2. Ontario Energy and Property Tax Credit (Rent, energy, property tax) and 3. Northern Energy Credit (for taxpayers living in Northern Ontario) This benefit does not affect the tax return, It is paid out separately just like the GST and CTB credit.

Do You Understand 'Employment Expenses' on Your Tax Return? There are a wild variety of employment expense claims that tax-filers make. Dry cleaning and teeth-whitening for on-air performers? 09.07.2016 · 7 How to file refund return ITR 1 for commission income ITR 1 for LIC agent (AY 2016 17) Project - Make Knowledge free By - Amlan Dutta Declare commission …

Utah State Tax Commission 210 North 1950 West • Salt Lake City, Utah 84134 tax.utah.gov Get a faster refund! your Utah income tax return. See page 10 for more information and a worksheet to help you calcu- • 100 percent of your 2018 tax liability (2018 TC-40 line 27 plus line 30); or Easy income tax calculator for an accurate Ontario tax return estimate. Your 2019 Ontario income tax refund could be even bigger this year. Enter your annual income, taxes paid & RRSP contribution into our calculator to estimate your return.

enter $5,055. If your net income for the year will be between $37,635 and $71,335 and you want to calculate a partial claim, get Form TD1ON-WS, Worksheet for the 2018 Ontario Personal Tax Credits Return, and fill in the appropriate section. 3. enter $5,055. If your net income for the year will be between $37,635 and $71,335 and you want to calculate a partial claim, get Form TD1ON-WS, Worksheet for the 2018 Ontario Personal Tax Credits Return, and fill in the appropriate section. 3.

A sales employee may receive a sales commission, usually in addition to base pay, for meeting or exceeding a specific sales target in a specific period of time. This commission may be a percentage of sales or a percentage of a base amount of sales. An insurance agent, typically an independent agent or non-employee agent, makes a commission on the sale of an insurance policy. Learn about income tax returns, consumption taxes, and the programs and credits for individuals, self-employed persons and members of a partnership. Find out more. Your Situation Low income, owner, parent, student, support payments… Selected subsection: Income Tax Return Online filing, deadline, line-by …

Commissions, certain finder's fees and "kickbacks" to sales persons for arranging financing or insurance are all taxable income. When determining how to report the income on a tax return, the important question is whether the sales person is an employee or an independent contractor. The tax rate to be used on the EHT annual return is based on the actual Ontario payroll paid by the employer during the year. Since the tax payable on the return may differ from the tax paid on the instalments during the year, a debit or credit balance may arise at year-end.

Adjustment for income replacement indemnities. If you were resident in Québec on December 31, 2019, and you received income replacement indemnities or compensation for the loss of financial support from the CNESST or the SAAQ, enter the amount from Box M of your RL-5 slip (maximum $13,742.10). This will reduce the basic personal amount for 2019, which was taken into account in calculating Improvements to Ontario's tax services include updating the RST return to make it easier for you to read and use. This document provides instructions on how to complete your RST return.

One of the reporting requirements for Canadians who operate businesses is to include industry codes as part of their tax return. There is a standardized list of applicable codes, but few people are familiar with it. Make sure you choose the correct code for your business so you can file a complete return… Go back to the "Total Income" section on the first page of your T1 income tax return. You will see a subsection titled “Self employment income." Enter your gross and net business, professional, or commission income on the appropriate line.

2018 Income Tax and Benefit Return Step 1 – Identification and other information ON 8 If you became or ceased to be a resident of Canada for income tax purposes in 2018, enter the date of: entry Month Day or departure Month Day donate some or all of your 2018 refund to the Ontario opportunities fund. Learn about income tax returns, consumption taxes, and the programs and credits for individuals, self-employed persons and members of a partnership. Find out more. Your Situation Low income, owner, parent, student, support payments… Selected subsection: Income Tax Return Online filing, deadline, line-by …

One of the reporting requirements for Canadians who operate businesses is to include industry codes as part of their tax return. There is a standardized list of applicable codes, but few people are familiar with it. Make sure you choose the correct code for your business so you can file a complete return… Individual tax return instructions 2018. The following information will help you with completing your tax return for 2018. These instructions are in the same order as the questions on the Tax return for individuals 2018.

If you received a Form 1099, you'll find your commission earnings in box 7. Report this commission and other income on line 1 of your Schedule C or Schedule C-EZ. You will also use the Schedule C or C-EZ to report commission income if you receive a W-2 with the statutory employee box checked on line 13. As a commission employee, there are a variety of expenses that you can claim on form T777, Statement of Employment Expenses, when you file your personal income tax return.These costs commonly include accounting fees, legal fees, and costs for business cards, promotional gifts, cellphones, and computers.

Other taxable income 2018 (HS325) GOV.UK

Employer Health Tax Ministry of Finance. 12.07.2019 · Self Assessment tax returns - deadlines, who must send a tax return, penalties, corrections, paying your tax bill and returns for someone who has died, If you live in Ontario, you may qualify for the Ontario Energy and Property Tax Credit (OEPTC), that is a part of the Ontario Trillium Benefit.. Though we technically are not claiming rent on our taxes, the amount of rent, property taxes, or long term housing costs paid by you throughout the year is used to help calculate your benefit..

Completing the Canadian T1 Business Income Tax Form

Where Do I List My Commission Income on a Tax Return. Easy income tax calculator for an accurate Ontario tax return estimate. Your 2019 Ontario income tax refund could be even bigger this year. Enter your annual income, taxes paid & RRSP contribution into our calculator to estimate your return., A sales employee may receive a sales commission, usually in addition to base pay, for meeting or exceeding a specific sales target in a specific period of time. This commission may be a percentage of sales or a percentage of a base amount of sales. An insurance agent, typically an independent agent or non-employee agent, makes a commission on the sale of an insurance policy..

As a commission employee, there are a variety of expenses that you can claim on form T777, Statement of Employment Expenses, when you file your personal income tax return.These costs commonly include accounting fees, legal fees, and costs for business cards, promotional gifts, cellphones, and computers. Do You Understand 'Employment Expenses' on Your Tax Return? There are a wild variety of employment expense claims that tax-filers make. Dry cleaning and teeth-whitening for on-air performers?

This program combines 1. Ontario Sales Tax, 2. Ontario Energy and Property Tax Credit (Rent, energy, property tax) and 3. Northern Energy Credit (for taxpayers living in Northern Ontario) This benefit does not affect the tax return, It is paid out separately just like the GST and CTB credit. Current tax rates in Ontario and federal tax rates are listed below and check. IMPORTANT: This tax calculator is used for income tax estimation. Please use Intuit TurboTax if you want to fill your tax return and get tax rebate for previous year. It is free for simple tax returns or gives you 10% discount for more complicated tax returns.

Current tax rates in Ontario and federal tax rates are listed below and check. IMPORTANT: This tax calculator is used for income tax estimation. Please use Intuit TurboTax if you want to fill your tax return and get tax rebate for previous year. It is free for simple tax returns or gives you 10% discount for more complicated tax returns. 12.07.2019 · Self Assessment tax returns - deadlines, who must send a tax return, penalties, corrections, paying your tax bill and returns for someone who has died

This program combines 1. Ontario Sales Tax, 2. Ontario Energy and Property Tax Credit (Rent, energy, property tax) and 3. Northern Energy Credit (for taxpayers living in Northern Ontario) This benefit does not affect the tax return, It is paid out separately just like the GST and CTB credit. 23.03.2018 · I am getting lots of queries daily which are: I am LIC agent which ITR I have to file: I have income from commission can I file ITR 4S etc. so it this video you will get to know which ITR to file

29.01.2020 · Employees who earn commissions with expenses. Employees who are paid in whole or in part by commission and who claim expenses may choose to fill out a Form TD1X, Statement of Commission Income and Expenses for Payroll Tax Deductions in addition to Form TD1. To calculate the amount of tax to deduct, you can use the Payroll Deductions Online Calculator, the Payroll Deductions … As a commission employee, there are a variety of expenses that you can claim on form T777, Statement of Employment Expenses, when you file your personal income tax return.These costs commonly include accounting fees, legal fees, and costs for business cards, promotional gifts, cellphones, and computers.

29.01.2020 · Employees who earn commissions with expenses. Employees who are paid in whole or in part by commission and who claim expenses may choose to fill out a Form TD1X, Statement of Commission Income and Expenses for Payroll Tax Deductions in addition to Form TD1. To calculate the amount of tax to deduct, you can use the Payroll Deductions Online Calculator, the Payroll Deductions … I would create a service item called commission earned, select your commission income account on the item screen. use that item on a sales receipt when you get the commission and then deposit the funds (you can use a generic customer, or create that company as a customer <- if there is any chance other companies will be paying you in the future this is the better option.

A sales employee may receive a sales commission, usually in addition to base pay, for meeting or exceeding a specific sales target in a specific period of time. This commission may be a percentage of sales or a percentage of a base amount of sales. An insurance agent, typically an independent agent or non-employee agent, makes a commission on the sale of an insurance policy. Income tax calculator for Ontario and Canada gross income of 2020, tax return that needs to be made in 2020.

Easy income tax calculator for an accurate Ontario tax return estimate. Your 2019 Ontario income tax refund could be even bigger this year. Enter your annual income, taxes paid & RRSP contribution into our calculator to estimate your return. Lodge online. Lodging online with myTax is the quick, easy, safe and secure way for you to prepare and lodge your own tax return. The deadline to lodge your tax return is 31 October. Benefits of lodging with myTax. Most information from your employers, banks, government agencies, health funds and other third parties is pre-filled by mid-August

As a commission employee, there are a variety of expenses that you can claim on form T777, Statement of Employment Expenses, when you file your personal income tax return.These costs commonly include accounting fees, legal fees, and costs for business cards, promotional gifts, cellphones, and computers. The tax rate to be used on the EHT annual return is based on the actual Ontario payroll paid by the employer during the year. Since the tax payable on the return may differ from the tax paid on the instalments during the year, a debit or credit balance may arise at year-end.

12.07.2019 · Self Assessment tax returns - deadlines, who must send a tax return, penalties, corrections, paying your tax bill and returns for someone who has died Go back to the "Total Income" section on the first page of your T1 income tax return. You will see a subsection titled “Self employment income." Enter your gross and net business, professional, or commission income on the appropriate line.

Income tax calculator for Ontario and Canada gross income of 2020, tax return that needs to be made in 2020. Can I Deduct Realtors' Commissions on My Income Tax Return? By: or $500,000 on a joint return, Everything from the size of the commission to who pays it may be negotiable in a sale.

Completing the Canadian T1 Business Income Tax Form. One of the reporting requirements for Canadians who operate businesses is to include industry codes as part of their tax return. There is a standardized list of applicable codes, but few people are familiar with it. Make sure you choose the correct code for your business so you can file a complete return…, One of the reporting requirements for Canadians who operate businesses is to include industry codes as part of their tax return. There is a standardized list of applicable codes, but few people are familiar with it. Make sure you choose the correct code for your business so you can file a complete return….

Ontario Canada.ca

Financial Services Commission of Ontario. fsco.gov.on.ca. Lodge online. Lodging online with myTax is the quick, easy, safe and secure way for you to prepare and lodge your own tax return. The deadline to lodge your tax return is 31 October. Benefits of lodging with myTax. Most information from your employers, banks, government agencies, health funds and other third parties is pre-filled by mid-August, This program combines 1. Ontario Sales Tax, 2. Ontario Energy and Property Tax Credit (Rent, energy, property tax) and 3. Northern Energy Credit (for taxpayers living in Northern Ontario) This benefit does not affect the tax return, It is paid out separately just like the GST and CTB credit..

How to Report Commission Income Budgeting Money

Completing the Canadian T1 Business Income Tax Form. Employer Health Tax (EHT) is a payroll tax on remuneration paid to employees and former employees. Effective January 1, 2019, the EHT exemption is increased from $450,000 to $490,000. The EHT exemption is adjusted according to inflation every five years using the Ontario Consumer Price Index. https://en.wikipedia.org/wiki/Flint_water_crisis I would create a service item called commission earned, select your commission income account on the item screen. use that item on a sales receipt when you get the commission and then deposit the funds (you can use a generic customer, or create that company as a customer <- if there is any chance other companies will be paying you in the future this is the better option..

Individual tax return instructions 2018. The following information will help you with completing your tax return for 2018. These instructions are in the same order as the questions on the Tax return for individuals 2018. Lodge online. Lodging online with myTax is the quick, easy, safe and secure way for you to prepare and lodge your own tax return. The deadline to lodge your tax return is 31 October. Benefits of lodging with myTax. Most information from your employers, banks, government agencies, health funds and other third parties is pre-filled by mid-August

One of the reporting requirements for Canadians who operate businesses is to include industry codes as part of their tax return. There is a standardized list of applicable codes, but few people are familiar with it. Make sure you choose the correct code for your business so you can file a complete return… 09.07.2016 · 7 How to file refund return ITR 1 for commission income ITR 1 for LIC agent (AY 2016 17) Project - Make Knowledge free By - Amlan Dutta Declare commission …

18.07.2019 · Organize and file your tax returns, receipts and supporting documents by tax year so you can retrieve them easily in case you are ever reviewed. Filing your tax return. In most cases, you have to file your personal tax return — the T1 Income Tax and Benefit Return — by April 30 of the year following the tax … Current tax rates in Ontario and federal tax rates are listed below and check. IMPORTANT: This tax calculator is used for income tax estimation. Please use Intuit TurboTax if you want to fill your tax return and get tax rebate for previous year. It is free for simple tax returns or gives you 10% discount for more complicated tax returns.

Learn about income tax returns, consumption taxes, and the programs and credits for individuals, self-employed persons and members of a partnership. Find out more. Your Situation Low income, owner, parent, student, support payments… Selected subsection: Income Tax Return Online filing, deadline, line-by … Other taxable income 2018 (HS325 commission and freelance income that’s not If you haven’t included that tax in box 2 of the Employment page of your tax return, enter it in

Ontario - 2019 Income Tax Package. Filing online. File online for free - Free certified software products are available to file your income tax return online. Filing … Adjustment for income replacement indemnities. If you were resident in Québec on December 31, 2019, and you received income replacement indemnities or compensation for the loss of financial support from the CNESST or the SAAQ, enter the amount from Box M of your RL-5 slip (maximum $13,742.10). This will reduce the basic personal amount for 2019, which was taken into account in calculating

I would create a service item called commission earned, select your commission income account on the item screen. use that item on a sales receipt when you get the commission and then deposit the funds (you can use a generic customer, or create that company as a customer <- if there is any chance other companies will be paying you in the future this is the better option. Individual tax return instructions 2018. The following information will help you with completing your tax return for 2018. These instructions are in the same order as the questions on the Tax return for individuals 2018.

Other taxable income 2018 (HS325 commission and freelance income that’s not If you haven’t included that tax in box 2 of the Employment page of your tax return, enter it in 09.07.2016 · 7 How to file refund return ITR 1 for commission income ITR 1 for LIC agent (AY 2016 17) Project - Make Knowledge free By - Amlan Dutta Declare commission …

The tax rate to be used on the EHT annual return is based on the actual Ontario payroll paid by the employer during the year. Since the tax payable on the return may differ from the tax paid on the instalments during the year, a debit or credit balance may arise at year-end. 12.07.2019 · Self Assessment tax returns - deadlines, who must send a tax return, penalties, corrections, paying your tax bill and returns for someone who has died

Improvements to Ontario's tax services include updating the RST return to make it easier for you to read and use. This document provides instructions on how to complete your RST return. 02.02.2018 · Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable. Because tax rules change from year to year, your tax refund might change even if your salary and deductions don’t change. In other words, you might get different results for the 2019 tax year than you did for 2018.

02.02.2018 · Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable. Because tax rules change from year to year, your tax refund might change even if your salary and deductions don’t change. In other words, you might get different results for the 2019 tax year than you did for 2018. Enter the total and attach a statement to your tax return that itemizes where the income came from if you had many sources of other income during the course of the year. You couldn't report "other income" on Forms 1040EZ or 1040A through 2017, and these forms were repealed in the 2018 tax year in any event.

Other taxable income 2018 (HS325 commission and freelance income that’s not If you haven’t included that tax in box 2 of the Employment page of your tax return, enter it in The tax rate to be used on the EHT annual return is based on the actual Ontario payroll paid by the employer during the year. Since the tax payable on the return may differ from the tax paid on the instalments during the year, a debit or credit balance may arise at year-end.